Market analysis and planning for business success: the Behome case

Author: Pasquale Sarubbi

Date: 15-03-2024

The furniture sector in Italy has always been one of the pillars of the national economy, thanks to the robust manufacturing tradition associated with the prestigious “made in Italy.” In 2022, the wood-furniture supply chain reached a valuation of 49 billion euros, while the furniture macrosystem in the same year was valued at 29 billion euros, registering a growth of 11 percent compared to 2021. Despite a slight contraction in 2020, mainly attributable to a decrease in domestic sales due to the COVID-19 pandemic, a steadily upward trend has been observed in recent years.

Significantly, about 37 percent of total sales are generated by exports, confirming the strong appreciation of Italian products abroad, both in terms of design and craftsmanship. This growth has been fueled mainly by three key factors: the lockdown, which has rekindled attention to the home; building bonuses enacted by the government, which have provided an additional boost; and increased supply through e-commerce.

Although the sector shows remarkable health and steady growth there are challenges to be faced in the short, medium and long term. The COVID-19 pandemic has exposed several fragilities in the global supply chain, making companies vulnerable.

Therefore, it will be imperative to optimize these chains by ensuring soundness and business continuity. Sustainability, both in products and production processes, will be central not only to meeting environmental challenges, but also to ensuring the success of a sector vital to the Italian economy. Most companies believe that ESG (environment, social, governance) is a trend that is destined to continue, both for sustainable development of the area and because it represents a source of competitive advantage.

Finally, the impact of new technologies, such as augmented reality and artificial intelligence, is rapidly revolutionizing the way consumers interact with the marketplace. Businesses will need to embrace these technologies to improve the customer experience and stay ahead in an ever-changing marketplace.

The furniture brand Behome, the subject of our study, was founded in 2020 and has rapidly gained ground in the Italian market. With currently 11 locations in Italy and an ongoing commitment to expansion, Behome focuses primarily on the sale of mid- to low-end products for all areas of the home. The brand’s distinctive strengths include a 5-year warranty, consulting services provided by interior designers, extensive product customization, and competitive pricing made possible through direct collaborations with the upstream supply chain.

Behome’s main target audience includes young and adult couples who seek design solutions, advice, service, and customization. However, the brand’s recent strategic transition aims to position itself in the mid-to-high end of the market, as desired by company management. Our study developed through three crucial phases to define the strategic directions necessary for Behome’s success.

The first phase involved an in-depth analysis of the industry through the study of reports, articles and specialized literature. This phase provided an in-depth understanding of the furniture industry context, allowing the team to identify key trends and challenges.

Subsequently, in-depth interviews with Behome’s top management allowed them to explore the internal dynamics of the company, assess the goals and expectations of the leadership. This step was crucial to understanding the company’s strategic vision and defining the specific challenges associated with the transition to the upper-middle market. Finally, a questionnaire was distributed to key industry stakeholders based on the information gathered during the interviews. This research phase allowed us to gather valuable feedback from customers and other key stakeholders, contributing to a comprehensive understanding of market dynamics. A critical component of this research was the identification of competitors with whom Behome aims to compete in the mid- to high-end. Six nationally known industry players emerged from an in-depth analysis, including established brands such as Scavolini, Chateau D’Ax, Lube, Veneta Cucine, Stosa Cucine, and Febal Casa.

This stage of competitor identification is critical to delineating a well-defined group, facilitating the search for and analysis of common characteristics that will be crucial to developing an effective strategy for improving Behome’s market positioning.

Our research involved a significant sample of 812 respondents, with a focus on 454 participants subjected to detailed analysis. This exclusion included those who said they had no experience in the furniture industry and the so-called “straight liners,” i.e., those who consistently give the same score to all submitted cases in evaluation questions.

Also, it is important to note that most respondents (88 percent) were concentrated in the South, suggesting greater participation from this region. The most represented age groups were those between 18 and 30 years old and those over 50.

The classic segmentation process proved crucial in the data analysis, as it provided the basis for the construction of demand segmentation. This strategy aims to group consumers into homogeneous categories, facilitating a more detailed understanding of preferences and purchasing behavior.

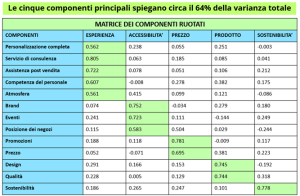

A key aspect of our approach was factor analysis, which is essential for an in-depth understanding of the factors that influence consumer choice. The analysis produced an explained variance of 64 percent, indicating the overall effectiveness of our model. The results reveal that the main drivers in consumers’ choice of furniture are related to experience, accessibility, price, product, and sustainability.

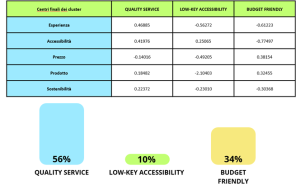

Next, to complete the classic segmentation process, our study incorporated cluster analysis. This crucial step made it possible to divide the participants into homogeneous groups, allowing us to clearly identify the niches of customers to focus on during Behome’s transition to the mid-to-high end of the furniture industry.

The analysis resulted in the identification of three main clusters, with the largest cluster named “Quality Service.” This designation reflects the prevalence of consumers within this cluster who direct their choices primarily by the key elements of experience and accessibility.

In the final stage of our analysis, a regression analysis was performed on all major players in the industry. This approach made it possible to identify so-called satisfaction drivers, highlighting the specific attributes that contribute to generating a higher level of satisfaction among consumers.

It clearly emerges that quality and atmosphere are the main drivers of satisfaction for companies that currently stand out in the market. In the regression on Lube, price emerges as a unique satisfaction driver that cannot be compared with other competitors. This could be attributed to the aggressive pricing and promotion strategy adopted by Lube in recent years, potentially influencing price at the expense of perceived quality.

Key managerial implications emerge from the analysis for Behome to achieve its desired goal. Quality emerges as an indispensable element, as improvement in this area can solidify the brand’s distinctive image. Regression analyses clearly indicate how quality is a relevant driver of satisfaction for the three leading brands in the industry.

However, quality alone is not enough. It is necessary to accompany the focus on quality with additional elements such as consulting, service management through tools such as augmented reality, continuous monitoring, and specific staff training. Continuing to focus on complete customization as a key differentiator is a winning strategy.

In addition, Behome could consider promoting experiential events to increase the interest of the target audience. Engaging experiences, such as showcooking, tastings and art events, can help leave a lasting impression on consumers.

An active commitment to promoting environmentally sustainable practices is essential. Acquiring recognized environmental certifications, such as Greenguard, Ecolabel, FSC, LEED, EPD and Carbonfootprint, not only meets growing market demands, but also consolidates Behome’s image as an environmentally conscious brand.

Finally, the atmosphere in the showrooms deserves special attention. A thorough study of the current atmosphere, evaluating aspects such as brightness, shapes, colors, and spaces, can identify areas for improvement and customization. Creating a multi-sensory and exciting space that stimulates the customer’s senses is crucial to long-term success.

It should be noted that, like any research, this is not without its limitations. The strong concentration in southern Italy by strategic and logistical choice given Behome’s established presence in southern Italy, the limited temporality of the data collected, the focus on specific variables to the exclusion of other potentially influential ones, and the dynamics of the market are aspects to consider when interpreting the results.