Private Labels vs. National Brands in Italian Retail: Strategies and Consumer Perceptions in the Meat Market

Author: Cosimo Malerba

Date: 04-07-2025

In recent years, the retail sector in Italy has undergone a profound transformation in the competitive balance between private labels and national brands. The meat segment, in particular, serves as a valuable case study to observe current dynamics: on one hand, the rise of private labels as increasingly influential players in value creation; on the other, the resilience of established industrial brands, supported by strong reputations and greater innovation capacity.

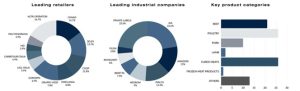

In Italy, retail currently accounts for around 75% of national food expenditure, generating annual revenues exceeding €135 billion. The meat segment, which includes both fresh and processed products, is worth over €9 billion and represents about 12% of total retail sales. Within this context, the coexistence of major retailers, food manufacturers, and private labels creates tension—but also opportunities for synergy and co-development.

The evolution of private labels and new consumer priorities in Italy

According to NielsenIQ data, private labels reached a 29% share of the Italian food market in 2024, growing by 5% over five years. Private labels are no longer associated only with affordability and price: today they offer premium, organic, and sustainable product lines capable of attracting increasingly conscious consumers who care about product origin and quality.

At the same time, consumer priorities in Italy are shifting. There is a growing interest in sustainable, local, and certified products. This trend is confirmed by the steady increase in demand for PDO and PGI meats, as well as heightened sensitivity toward animal welfare, traceability, and environmental responsibility. This interest is not merely ethical or cultural; it is reflected in purchasing behavior, with more consumers willing to pay higher prices for products perceived as healthier, more transparent, and authentic.

An empirical study: behavior, perceptions, and purchase motivations

To better understand consumer choices in Italy, a two-phase study was conducted. Following an initial qualitative exploratory phase, a quantitative survey collected 239 responses, 178 of which were complete. The sample, primarily composed of young adults aged 25–34, revealed that over 60% of respondents purchase meat from retail outlets in Italy, while showing increasing concern for non-economic factors.

Through multivariate analysis techniques, eight distinct consumer profiles were identified—four among retail shoppers and four among those who prefer traditional channels like butcher shops.

Among retail shoppers, the following profiles emerged:

- Ethical consumers – strongly oriented toward environmental and social sustainability;

- Refined consumers – focused on taste and perceived quality;

- Trendy consumers – influenced by advertising and brand image;

- Conscious consumers – attentive to health and environmental impact.

Among traditional channel consumers:

- Selective consumers – highly demanding in terms of freshness and artisanal quality;

- Popular consumers – influenced by brand recognition and word of mouth;

- Conscious consumers – sharing values and priorities with their retail counterparts;

- Ethical consumers – prioritizing transparency and responsibility of producers.

The comparison between the two types of brands revealed that private labels are perceived as more convenient and accessible, particularly in terms of perceived price and ease of purchase. Branded products, on the other hand, continue to be associated with higher levels of quality, sustainability, reliability, and traceability. When it comes to aspects such as product variety, certifications, and traceability, consumer perceptions are more balanced. This points to a market in which brand reputation and credibility, whether private label or national brand, can still be developed and strengthened.

Buying behaviors also differ: in retail, packaged and ready-to-eat formats dominate, while traditional channels retain their distinctive value in counter service, personal relationships with the butcher, and the ability to customize purchases.

Strategic implications for industry and retailers

The study yields relevant operational insights for all stakeholders in the Italian market. Private labels should definitively move beyond competing solely on price and focus on delivering a broader value proposition. This means investing in certified quality, transparent communication on traceability and sustainability, and placing the consumer at the center by leveraging digital tools to personalize the offering.

For national brands, reinforcing their premium positioning in Italy can be achieved through the enhancement of company identity, regional supply chains, tradition, and quality certifications. Ongoing product innovation and closer collaboration with retailers can improve shelf visibility and strategic consistency.

For retailers, it is essential to build coherent and credible brand architectures, manage assortments through a data-driven approach, and adopt ESG criteria in decision-making processes. Advanced use of consumer data can enable a personalized shopping experience and foster a more direct and longlasting relationship with the customer.

Finally, traditional channels, far from being obsolete, can leverage their relational and identity-based components while innovating their service models. The integration of digital solutions such as online reservations and local e-commerce, organizing experiential events or tastings, and collaborating with local producers can strengthen differentiation and customer loyalty.

Conclusions

The competition between private labels and national brands in the Italian meat segment is no longer driven solely by price, but by a complex set of factors: perceived quality, innovation, transparency, sustainability, and brand value coherence. In a fragmented and increasingly demanding market, understanding different consumer profiles and the motivational logic behind their choices is essential for building effective, credible, and responsive positioning strategies.