How can cosmetic companies triumph within the Italian Clean Beauty market?

The Clean Beauty market is very attractive for brands operating in the cosmetics industry because the market for natural and organic cosmetics is growing at almost twice the rate of the entire cosmetics market. To clarify the concept of Clean Beauty, according to the Beauty That Lasts Index developed by the cosmetic multinational Coty Inc., it can be summarised into the following four principles: Good for me, referring to products made of vegan, cruelty-free and non-harmful ingredients, Good for the Planet, therefore with a packaging aimed at reducing environmental impact, Good for people, that is celebrating ethnic and gender inclusivity through genderless makeup suitable for all skin tones, and Good to be Natural, namely with natural hero ingredients that benefit the skin.

Given the relevance of the clean cosmetics market, the market research was undertaken to understand the purchasing behaviour of clean cosmetic products in Italy and to identify the ideal strategies for brands that want to establish themselves as key players in the market.

Moreover, to achieve these objectives, two research questions have been investigated: What benefits do Italian consumers seek when purchasing a clean cosmetic product, which consequently maximise their satisfaction? Which are the most effective marketing strategies to dominate the clean cosmetics market in Italy?

Turning now to the analysis of data, the methodology employed was as follows: first, in-depth interviews were submitted to 5 respondents, specifically three women and two men aged between 22 and 55 years old, to investigate the subjective aspects behind their purchasing habits of cosmetics; then, the qualitative analysis was followed by a quantitative analysis aimed at collecting measurable data. CAWI interviews were submitted to 267 respondents chosen through a non-probability sampling method, 153 of which resulted to be relevant to the analysis after a data cleaning process. Specifically, 146 women and 7 men aged between 18 and 66 years old.

The results obtained were then analysed through the statistical software SPSS.

At this point, by means of univariate and bivariate analyses on the sample, it was deduced that it consists of 95% women and 5% men, 50% of them belonging to Generation Z and 23% to Generation Y. Moreover, among the main highlights: 86% of respondents already purchased a clean cosmetic product before being interviewed, 75% of them do not believe that clean cosmetics are less performing than traditional ones, 66% of respondents are willing to pay a premium price for a clean cosmetic product.

Finally, among the main reasons behind the purchase of clean cosmetics, respondents mentioned the well-being of their skin and the willingness to reduce their environmental impact.

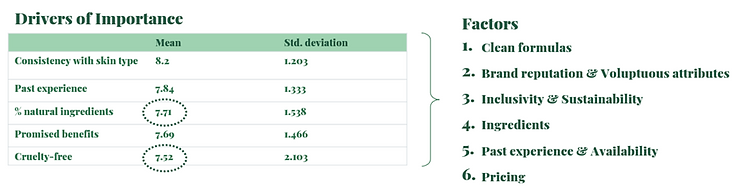

To answer the first research question, therefore, to identify major drivers of choice driving customers’ behaviour and main satisfaction drivers when it comes to buy a clean cosmetic product, respondents were asked to evaluate 20 items in terms of importance, first, and satisfaction, then.

Results showed the main drivers of choice are consistency with skin type, past experience, percentage of natural ingredients, promised benefits and cruelty-free ingredients.

Starting from the evaluation of importance for the 20 items, the complexity of the analysis was reduced through a factor analysis and 6 macrodrivers of importance were identified: Clean formulas, Brand reputation & Voluptuous attributes, Inclusivity and Sustainability, Ingredients, Past experience and Availability, Pricing.

Figure 1: Factor analysis

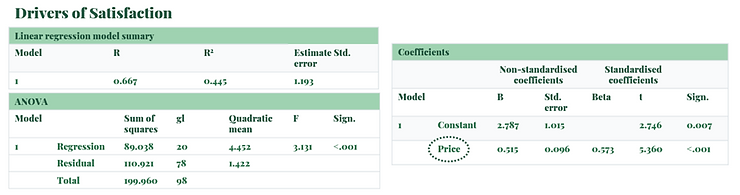

Also, a linear regression model was employed, and price resulted to be the only significant item affecting customers’ satisfaction (i.e., 45% of global satisfaction), this means there are other factors having a significant impact on satisfaction but not deducted from the linear regression model.

Figure 2: Multiple linear regression

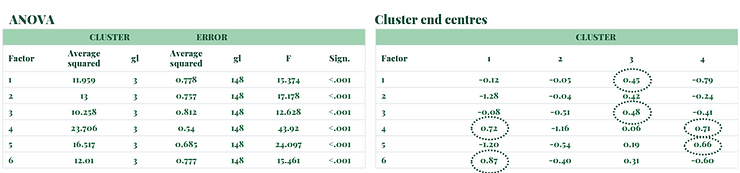

The six factors identified were then used to segment the sample through a cluster analysis, to identify groups of individuals, internally homogeneous and heterogeneous among themselves.

4 clusters have been extracted and these were named considering the importance each cluster gives to the six factors, they were respectively named as: Thrifty environmentalists, mainly searching for convenient prices and natural and cruelty-free ingredients, Conservative non environmentalists, generally disinterested in the market under analysis, Inclusive environmentalists, mainly interested in inclusivity & sustainability and clean formulas, Lazy environmentalists, mainly searching for natural and cruelty-free ingredients and easiness of procurement. Moreover, the two clusters resulting to be the most numerous were Inclusive and Lazy environmentalists: Inclusive environmentalists, representing 45% of respondents and mainly belonging to Generation Z and Y; Lazy environmentalists, representing 23% of respondents and mainly belonging to Generation Z and Y.

Figure 3: Cluster analysis

The analyses performed so far enabled to answer the first research question. At this point, a conjoint analysis has been carried out to answer the second research question, therefore, to identify the most effective marketing strategies companies should apply to become key players within the clean beauty market.

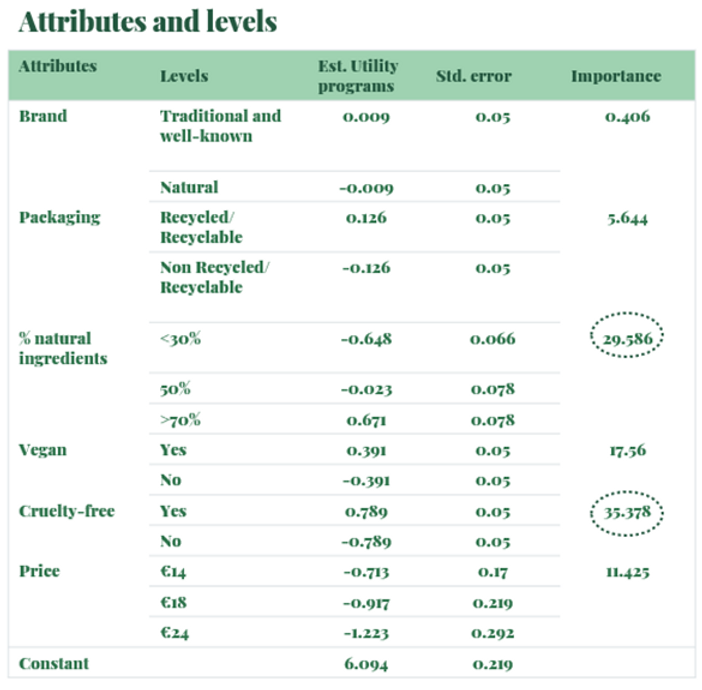

Respondents were asked to estimate the probability of purchase of 16 different offer profiles, differing for levels of selected attributes (i.e., brand, packaging, percentage of natural ingredients, connotation as vegan, cruelty-free ingredients, price) with the aim of drawing the ideal configuration of a clean cosmetic product. Also, to avoid undue abstractions by respondents, the profiles submitted for evaluation concerned a specific product category: a clean foundation.

The clean cosmetic product configuration, maximising customers’ utility resulted to be a clean foundation launched by a traditional and well-known brand, with recycled and recyclable packaging, more than 70% of natural ingredients, 100% vegan and cruelty-free and with a competitive price compared to the market average.

Figure 4: Conjoint analysis

Considering the results drawn from the analyses, the target group taken as reference audience for the development of the marketing strategy consists of: women belonging to Generation Z and Generation Y, represented by the profiles of Inclusive and Lazy environmentalists.

Moreover, the choice of Generation Z and Generation Y is strategic for firms, as capturing them at this young age means conquering customers of the future.

Lastly, it comes the description of the ideal strategy companies should implement to establish themselves as key players within the clean cosmetics market, following the McCarthy 4 P’s model. Starting from the Product, a clean cosmetic product should be beneficial for:

o People, developed with clean formulas that do not contain ingredients potentially harmful to the health of users and suitable for all kind of skins, even the most sensitive ones, free of ingredients of animal origin, with natural, ethically, and sustainably extracted ingredients

o The Planet, developed to reduce the environmental impact of its production, distribution, use and disposal as far as possible. To achieve this, it is proposed to follow the 4 R’s strategy: Reduce, Replace, Reuse and Recycle the packaging

o The Society, developed to enhance the individuality and distinctiveness of all human beings, promoting ethnic and gender inclusiveness, developing products that fit and cover all skin tones and that are suitable for both men and women

Concerning the Pricing strategy, an exit price has been suggested for a clean cosmetic foundation, by considering four elements: the average price for a traditional product in the mass beauty market (i.e., €5.56); the differential of perceived value in monetary terms for a clean foundation, obtained through the conjoint analysis (i.e., €15.7); the maximum willingness to pay for a clean foundation emerged from the differential of perceived value analysis and obtained by adding the two previously mentioned prices (i.e., €21.25); the average price applied for a clean cosmetic product within the mass market (i.e., €17.9).

Therefore, starting from a price of €5.56, by adding €15.7 a price of €21.25 has been reached. Then, this price has been refined according to the benchmark price of the target market to suggest a final price approximately between the maximum willingness to pay of the target audience (i.e., €21.25) and the benchmark of the market (i.e., €17.9), reaching a suggested price of €19.5. This is obviously a recommended price and, since production costs have not been considered, this price should be further refined.

Then, for what concerns the Placement strategy, given the competitive price and the high availability desidered by respondents, the suggested distribution strategy is mainly based on the SSS-drug channel, but it is also intended to suggest integration of hypermarkets, supermarkets, beauty shops and perfumeries among the selected channels.

Furthermore, given the young age of the target group and the increasing relevance of the online in terms of revenue share, distribution is also proposed on marketplaces: both SSS-Drug and beauty shops and perfumeries marketplaces, if present, and other, such as Amazon, ASOS, Douglas, Lookfantastic.

Lastly, regarding the Promotion strategy, two aspects have been taken into consideration: the young age of the target and the lack of information about clean beauty that still needs to be filled (25% of the respondents consider clean cosmetics to be less performing in terms of durability and compliance with the promised benefits). For these reasons, particular emphasis should be placed on social media communication, offering informative and emotional content on the brand’s Instagram, TikTok and Facebook pages, also through collaborations with influencers.