Electric cars (almost) on par with internal combustion engine vehicles: here’s why government purchase subsidies should be stopped

Author: Alessandro Rancati

Date: 12-09-2025

The European Union has chosen electric as the sole form of powering the sustainable mobility of the future because of its high efficiency (90%), zero CO2 emissions, and a lower total cost of ownership (TCO) than other green alternatives. The 2035 deadline for ending the marketing of all types of non-purely electric vehicles has led the entire automotive supply chain to move huge amounts of capital to upgrade its production facilities and develop this new technology. The public sector has also shown a commitment to supporting the development of electric mobility through incentive policies for citizens and companies. In particular, these have taken the form of government subsidies for the purchase of electric cars. While some countries, such as Germany, have decided to discontinue them, others, including Italy, maintain them in an uneven and uncertain manner. Either way, the data signal how these subsidies have not worked in launching demand for electric cars, necessitating reconsiderations on strategies to pursue.

Relevant factors in slowing the adoption of electric cars, according to a 2023 survey published in Statista, are high list price, lack of widespread charging infrastructure, travel anxiety, high charging costs, battery decay, and a higher depreciation of the electric vehicle. Despite this, travel anxiety and battery depreciation are now false myths, related to a lack of technological understanding of the market.

The goal of the research is to understand whether there is finally a convergence of annual depreciation rates for electric cars compared to ICE vehicles, which has always been predicted by industry experts and would further narrow the spectrum of factors limiting the demand for EVs.

Sample and statistical survey method

To perform the depreciation analysis, a dataset of used car ads for sale on the Autoscout24.com platform was constructed by exploiting the web scraping technique. More than 100,000 ads were extracted from the marketplace and reduced to 13,845 after a careful data cleaning procedure. The dataset contains listings published in seven countries, namely Italy, Germany, France, Austria, Spain, the Netherlands, and Belgium, and the brands of vehicles for sale are Mercedes-Benz, BMW, Audi, Renault, Volkswagen, and Tesla.

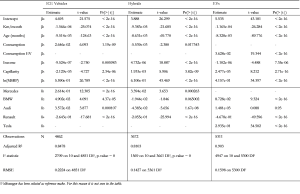

The dataset constructed is able to correctly represent the population of cars circulating in our country, due to the presence of vehicles belonging to each segment. In any case, the objective of conducting a comparison between different power supplies made it necessary to split the main one into three datasets: one for EVs, one for hybrids and one for ICE vehicles. Each was used to conduct a multiple linear regression analysis in order to find out how the selected independent variables were able to explain the resale price of the used car on the marketplace. Through descriptive analysis using boxplots, histograms, and scatterplots, the necessary logarithmic transformations were carried out, and observation of the correlation matrices does not reveal multicollinearity.

At last, electric cars do not depreciate more than the ICE counterparts, and this may lay the groundwork for their diffusion already in the short term

Until now, industry research has always pointed to a higher rate of depreciation of electric cars and justified it by several factors, including the rapid achievement of a state of technological obsolescence. But what emerges from the following analysis, which presents very positive levels of reliability and performance, is a reversal in the European scenario. EVs have an annual depreciation rate of 9.4%, hybrids 9.8% and ICE vehicles 10.9%, but the intention is to take a conservative position in light of the normal presence of an intrinsic error in the regression models. For this reason, I want to assume that there is no difference between the three categories: this would still be considerable progress, as it would mean that between EVs and conventional vehicles there has been a convergence of values. In addition to age, the variable with the greatest impact on resale price, average monthly mileage and MSRP are also factors with important relevance. The other factors were not further elaborated as the relative t-values suggest little impact while remaining significant. It was decided to conduct a sensitivity analysis on the three most relevant variables in order to observe the relative impact of monthly mileage and list price as the vehicle ages. It emerged that MSRP produces a greater deviation in vehicle value than monthly mileage, but in both cases the effect diminishes with vehicle age. This is readily explained: a very old car, regardless of whether it has low or high mileage and/or a low or high list price, is an unattractive vehicle in the marketplace, as consumers will look for a more modern option to reap the benefits it possesses.

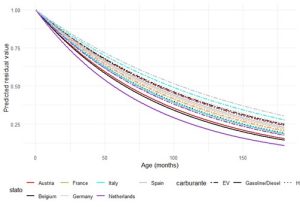

A final graphical representation to be made concerns the annual depreciation of the three vehicle types for each of the seven states considered in the analysis. Interestingly, the vehicles with the lowest depreciation are Spanish and Italian EVs, despite Spain and Italy being two of the advanced European economies to have the lowest market share of electric cars. This is presumably due to a higher average age of electric vehicles in countries with higher EV market share, such as the Netherlands, and a dominance of premium electric cars (such as Tesla) in the Italian and Spanish markets than in the Dutch market. In the Dutch EV dataset, in fact, it emerges that the most present model is the Renault Zoe, a significantly more budget-friendly car that is small and has fewer premium materials.

Strategies for the future: concentration of attention and resources in investments to increase the ubiquity of the charging network and in reducing the cost of energy

Having shown how there has been, at the very least, a convergence of depreciation rates between electric and ICE cars, the problems to be addressed come down to very high list prices and electricity costs and a low capillarity of the charging network. However, in some countries EVs should already be competitive on price, as looking at annual registration data shows the most purchased cars are in a price category within which some electric models already belong. If in several northern European countries the idea of a too high MSRP is outdated, in the south we will have to wait for electric models to enter the market that are able to compete with cars priced at just over 10,000 euros. In any case, the short-term outlook is that these more “democratic” EVs will arrive on the market, and therefore it can be said that the problem of high prices will soon be overcome. This leads me to say that the problems that need to be concretely addressed are the ubiquity of the charging network and the very high energy costs. And it is at this point that the title of the article is justified: in the face of empirical market feedback, government subsidies offered to individuals to purchase an electric car should be suspended permanently and diverted to greater investment in the installation of public, home-based and company-based charging points. It would be more appropriate, therefore, to concentrate resources in the creation of an infrastructure network on the territory that would be able to guarantee the consumer the security of locating a charging point within a few kilometers at any time. The other area of intervention, on the other hand, is energy and concerns Italy in particular: the supply of electricity, still largely dependent on gas, is one of the most expensive in Europe, not only as a result of the higher cost of the raw material but also because of the current system of energy pricing, which involves the application of the price of the last unit of production needed to meet demand, namely gas. In order to launch the demand for electric cars, it will also be necessary to increase investment in renewables to increase their contribution and develop a reform of the electricity pricing system to make electric more economically competitive over endothermic.

Conclusions

The European Union’s choice not to embrace a multi-technology approach to decarbonizing the transport sector is certainly a matter of criticism at the political level because of its technical implications. However, electric mobility is currently the only applicable alternative in the medium term to meet European climate goals, and public support for its development is a necessity. Nonetheless, the lack of success of subsidies for the purchase of electric cars and the gradual fall of various factors limiting their adoption must lead institutions to reconsider their investment strategy. To launch the demand for electric cars, structural interventions are needed that can improve the conditions for the use of this type of vehicle, so as to create an environment of consumer confidence and a situation of real affordability compared to endothermic vehicles. Redistributive interventions will never be able to create a structural change in the transportation sector, but will prolong temporary alterations over time.